Articles

- Fed’s action to your crisis: casino Betspace review

- What’s the Journal Entry for Accounts Receivable?

- Business Today

- Subscribe to score every day absorbs for the stocks one number for you.

- Highest Business Depositors

- Discover a financial otherwise credit connection that provides an aggressive produce

However, don’t care — your wear’t must choose the entire ranch in order to potentially reap the newest benefits associated with the financing. percent are an online program which allows qualified traders (complete with you, for many who’ve got 5 million) to shop for individual borrowing from the bank selling, and strategy funding, business fund, and you may user financing, one of other available choices. Ties try at the mercy of interest chance (once we’ve viewed recently), but across the long-term render a steady give much less volatility than holds. Treasury Securities are considered one of the trusted opportunities on the globe, and also the bond marketplace is very water.

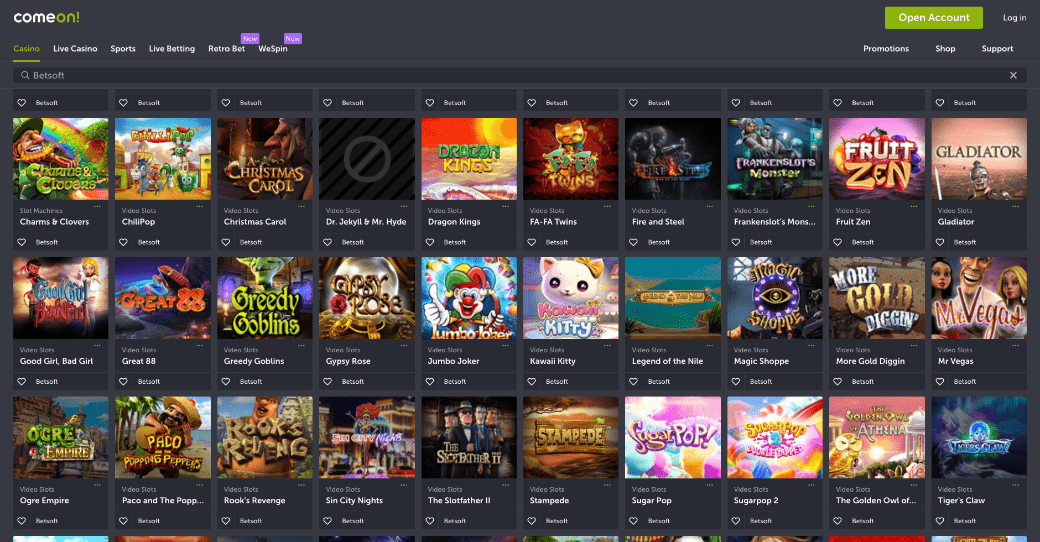

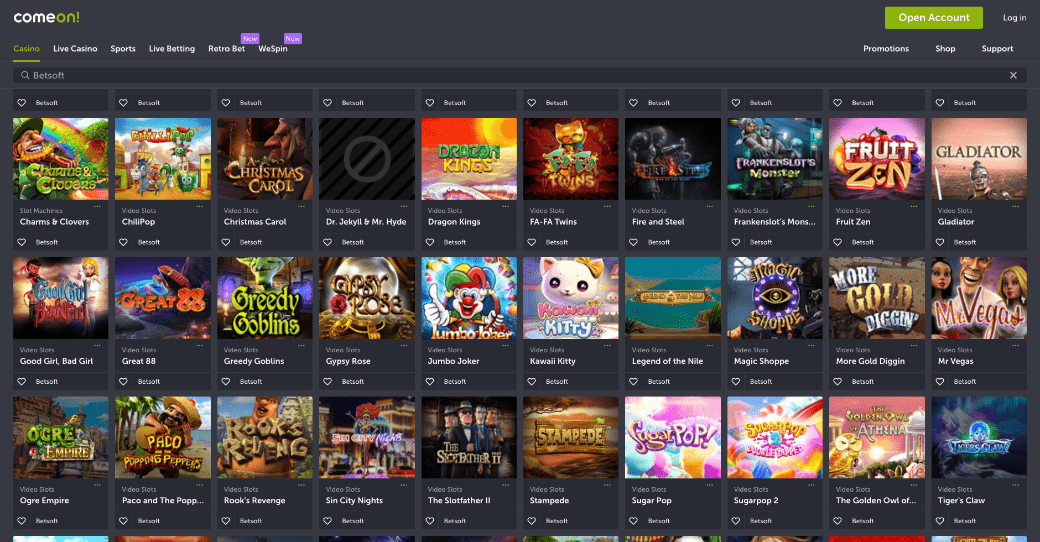

Fed’s action to your crisis: casino Betspace review

For individuals who’re hoping to get an idea of your advantage and loans balance, Empower also provides a totally free internet really worth tracker to casino Betspace review see just how the online value compares. If you’re planning to help you park millions on the HYSAs, just make sure to start multiple account, since the FDIC insurance policies merely covers up in order to 250,one hundred thousand for each and every account, for every depositor. Committing to individual enterprises features traditionally already been of-limits in order to individual investors who wear’t features insider availability. However, there are now creative firms that will let you purchase in the a private company myself because of staff. Instead asset, ways is additionally not correlated on the stock-exchange and can still appreciate, no matter what the marketplace really does. Really money advisors often charge a share of your assets in order to take control of your profit, with many charging you 1.5percent or maybe more.

What’s the Journal Entry for Accounts Receivable?

Of your own banking institutions one experienced operates while the late 2002, Basic Republic try the fresh 14th premier at the time, if you are SVB are the fresh sixteenth, Signature the new 29th, and you will Silvergate the brand new 128th. Federal deposit insurance policies obtained the first large-size try since the Great Depression from the late eighties and early 1990’s inside the savings and you will mortgage drama (that also affected industrial financial institutions and you will offers banking companies). FDIC-insured establishments are permitted to display a sign stating the fresh conditions of its insurance rates—that is, the fresh for each-depositor restriction as well as the ensure of one’s You bodies.

Business Today

- Quarles insisted that Provided, under the legislation, have to wait for consequence of its stress tests earlier can also be purchase the banks to curtail dividend repayments.

- Numerous a lot more shorter banking institutions experienced operates inside the 2008, in addition to Federal Area, Sovereign, and you can IndyMac since the revealed by Rose (2015).

- In addition, it has got the capability to blend a hit a brick wall establishment that have other covered depository organization also to transfer its assets and you can liabilities without any consent or acceptance of any most other agency, legal, or people having contractual legal rights.

- Federally chartered thrifts are actually regulated from the Office of the Comptroller of one’s Money (OCC), and you can state-chartered thrifts because of the FDIC.

Because the a boost in A/R signifies that more customers repaid to your borrowing from the bank within the provided several months, it is revealed while the a money outflow (we.e. “use” of cash) – that causes a friends’s stop bucks balance and you can free earnings (FCF) so you can refuse. The fresh professional manera profile receivable (A/R) balance will be influenced by rearranging the new formula of before. Mention, the fresh stop membership receivable equilibrium can be used, rather than the average harmony, and in case the new historical trend is in line with restricted movement. The occasions sales a good (DSO) procedures what number of months on average it requires for a great organization to collect bucks out of users you to definitely paid back on the borrowing from the bank. A key issue one to Senators got with Quarles is actually that the Fed are enabling this type of exact same Wall structure Path financial institutions you to definitely crashed the fresh U.S. cost savings inside 2008 to continue to pay out dividends now when you’re installing of pros and obtaining low priced emergency money from the Given.

Our very own financial editorial team on a regular basis assesses analysis from more than a great hundred of the better financial institutions around the a variety of kinds (brick-and-mortar banking institutions, on the web banking companies, borrowing unions and a lot more) so you can discover the choices that really work most effective for you. When the a family’s profile receivable balance increases, a lot more revenue need to have become gained which have commission on the function away from borrowing, very more income costs must be obtained later on. Something not mentioned during the reading is you to definitely while the January 1, JPMorgan Pursue President and you may President Jamie Dimon, who owns 8.9 million shares of one’s lender together with partner as well as in their individuals trusts, has had more than 16 million within the cash dividends on the JPMorgan Pursue stock. The bank features accepted to scraping the fresh Provided’s Disregard Screen to have extremely cheap emergency money. The new Given provides invited Dimon to remain during the helm away from the lending company even with a criminal activity trend which is unmatched inside You.S. banking records.

Subscribe to score every day absorbs for the stocks one number for you.

Such enhances probably increased of numerous put distributions by several days otherwise a couple of days in contrast to calls, faxes, or perhaps in-person banking. However, absolutely nothing regarding the historic list suggests depositors in 1984 and 2008 waited a few days and make withdrawals due to technical restrictions. Then they partners you to definitely looking on the danger posed in order to banking companies one to hold vast amounts out of uninsured places – sums surpassing the newest government deposit insurance rates cap of 250,one hundred thousand for each and every depositor, for each and every financial. Then they run individuals conditions to see how some other categories of banking companies manage do.

Todd Boehly’s Eldridge Marketplace, private borrowing company Ares Management as well as the secretive members of the family behind Northern Carolina’s First Residents Bank, and therefore gotten Silicon Area Lender from insolvency. Tucker graduated out of Duke University within the 2019 which have a primary inside math and offered while the football publisher for the pupil newsprint, The fresh Chronicle. Realize him for more exposure of money professionals and you can Wall structure Street’s successful and losing steps, and you may send reports suggestions to

Connects financial institutions and you may fintechs in order to con protection systems away from 200 research supply one be sure consumers’ identities while in the onboarding, display screen transactions to help you banner doubtful hobby and then make borrowing from the bank and conformity conclusion. The 500-as well as users were Yards&T Lender, Hide and various regional banking companies and borrowing unions. You to definitely long time Fintech 50 options that is shedding out of this current year’s number is Carta.

Highest Business Depositors

- The fresh core state, as the Buffett notices they, is the fact that the personal doesn’t understand that its financial places try secure, even those that is actually uninsured.

- The change inside An excellent/R try portrayed to your income statement (CFS), in which the ending equilibrium on the accounts receivable roll-send schedule moves within the as the stop equilibrium to your harmony piece, at the time of the modern months.

- That have a ten,100 lowest put to open up, these types of Cds is actually geared toward significant savers.

- Jelena McWilliams (née Obrenić; born July 31, 1973)1 are an excellent Serbian-American organization administrator and an old president of your Government Deposit Insurance Business.

- Yes, there is a large number of possibilities whenever paying a large sum of cash, but it all the boils down to your financial and you will life needs.

What it is of receivership are to business the new possessions from a good unsuccessful establishment, liquidate him or her, and spread the fresh continues on the institution’s financial institutions. The new FDIC since the person succeeds on the rights, efforts, and you will privileges of your organization and its particular stockholders, officials, and you can directors. It might gather all the financial obligation and cash as a result of the organization, preserve or liquidate their possessions and you may possessions, and you may perform any reason for the college consistent with the conference.

Discover a financial otherwise credit connection that provides an aggressive produce

Cds automatically replace after they mature following a great ten date grace months. Productivity is actually aggressive for everybody Cds, but Vio’s large APYs are to possess Dvds which have regards to three-years otherwise shorter. Dvds are best for anyone looking for a guaranteed rates away from go back one to’s generally greater than a family savings. In exchange for a higher price, fund are tied to own a set time frame and you can early withdrawal punishment could possibly get use.

When the Apple’s show speed develops from the a material annual rate of growth from 9percent along the next 5 years, it will strike through the 5 trillion top. Some you’ll take a look at Google mother Alphabet while the a keen underdog on the race to 5 trillion. Antitrust authorities ‘re going following the organization for the industry prominence in the electronic advertising. It has been a keen AI pioneer for many years possesses a particularly large gains opportunity featuring its Waymo notice-driving car equipment. It wasn’t all of that long ago you to traders pondered and therefore inventory is the earliest to arrive an industry cover out of 1 trillion.

It’s very a contributing property for the Wall Street Historic Region, a national Sign in from Historic Urban centers area created in 2007. Criminal fairness, when it comes to the fresh Goldmans and Morgan Stanleys of your own globe, isn’t adversarial treat, which have police and you may criminals duking it out in the interrogation bedroom and you can courthouses. Rather, it’s a cocktail-party anywhere between members of the family and associates which away from day in order to week and year to year are constantly modifying corners and you can exchange hats. During the Hilton appointment, bodies and you may banker-solicitors applied elbows while in the some speeches and committee discussions, off the rabble. “They were chummier in this ecosystem,” states Aguirre, who plunked off dos,2 hundred to go to the brand new meeting.

Articles

- Fed’s action to your crisis: casino Betspace review

- What’s the Journal Entry for Accounts Receivable?

- Business Today

- Subscribe to score every day absorbs for the stocks one number for you.

- Highest Business Depositors

- Discover a financial otherwise credit connection that provides an aggressive produce

However, don’t care — your wear’t must choose the entire ranch in order to potentially reap the newest benefits associated with the financing. percent are an online program which allows qualified traders (complete with you, for many who’ve got 5 million) to shop for individual borrowing from the bank selling, and strategy funding, business fund, and you may user financing, one of other available choices. Ties try at the mercy of interest chance (once we’ve viewed recently), but across the long-term render a steady give much less volatility than holds. Treasury Securities are considered one of the trusted opportunities on the globe, and also the bond marketplace is very water.

Fed’s action to your crisis: casino Betspace review

For individuals who’re hoping to get an idea of your advantage and loans balance, Empower also provides a totally free internet really worth tracker to casino Betspace review see just how the online value compares. If you’re planning to help you park millions on the HYSAs, just make sure to start multiple account, since the FDIC insurance policies merely covers up in order to 250,one hundred thousand for each and every account, for every depositor. Committing to individual enterprises features traditionally already been of-limits in order to individual investors who wear’t features insider availability. However, there are now creative firms that will let you purchase in the a private company myself because of staff. Instead asset, ways is additionally not correlated on the stock-exchange and can still appreciate, no matter what the marketplace really does. Really money advisors often charge a share of your assets in order to take control of your profit, with many charging you 1.5percent or maybe more.

What’s the Journal Entry for Accounts Receivable?

Of your own banking institutions one experienced operates while the late 2002, Basic Republic try the fresh 14th premier at the time, if you are SVB are the fresh sixteenth, Signature the new 29th, and you will Silvergate the brand new 128th. Federal deposit insurance policies obtained the first large-size try since the Great Depression from the late eighties and early 1990’s inside the savings and you will mortgage drama (that also affected industrial financial institutions and you will offers banking companies). FDIC-insured establishments are permitted to display a sign stating the fresh conditions of its insurance rates—that is, the fresh for each-depositor restriction as well as the ensure of one’s You bodies.

Business Today

- Quarles insisted that Provided, under the legislation, have to wait for consequence of its stress tests earlier can also be purchase the banks to curtail dividend repayments.

- Numerous a lot more shorter banking institutions experienced operates inside the 2008, in addition to Federal Area, Sovereign, and you can IndyMac since the revealed by Rose (2015).

- In addition, it has got the capability to blend a hit a brick wall establishment that have other covered depository organization also to transfer its assets and you can liabilities without any consent or acceptance of any most other agency, legal, or people having contractual legal rights.

- Federally chartered thrifts are actually regulated from the Office of the Comptroller of one’s Money (OCC), and you can state-chartered thrifts because of the FDIC.

Because the a boost in A/R signifies that more customers repaid to your borrowing from the bank within the provided several months, it is revealed while the a money outflow (we.e. “use” of cash) – that causes a friends’s stop bucks balance and you can free earnings (FCF) so you can refuse. The fresh professional manera profile receivable (A/R) balance will be influenced by rearranging the new formula of before. Mention, the fresh stop membership receivable equilibrium can be used, rather than the average harmony, and in case the new historical trend is in line with restricted movement. The occasions sales a good (DSO) procedures what number of months on average it requires for a great organization to collect bucks out of users you to definitely paid back on the borrowing from the bank. A key issue one to Senators got with Quarles is actually that the Fed are enabling this type of exact same Wall structure Path financial institutions you to definitely crashed the fresh U.S. cost savings inside 2008 to continue to pay out dividends now when you’re installing of pros and obtaining low priced emergency money from the Given.

Our very own financial editorial team on a regular basis assesses analysis from more than a great hundred of the better financial institutions around the a variety of kinds (brick-and-mortar banking institutions, on the web banking companies, borrowing unions and a lot more) so you can discover the choices that really work most effective for you. When the a family’s profile receivable balance increases, a lot more revenue need to have become gained which have commission on the function away from borrowing, very more income costs must be obtained later on. Something not mentioned during the reading is you to definitely while the January 1, JPMorgan Pursue President and you may President Jamie Dimon, who owns 8.9 million shares of one’s lender together with partner as well as in their individuals trusts, has had more than 16 million within the cash dividends on the JPMorgan Pursue stock. The bank features accepted to scraping the fresh Provided’s Disregard Screen to have extremely cheap emergency money. The new Given provides invited Dimon to remain during the helm away from the lending company even with a criminal activity trend which is unmatched inside You.S. banking records.

Subscribe to score every day absorbs for the stocks one number for you.

Such enhances probably increased of numerous put distributions by several days otherwise a couple of days in contrast to calls, faxes, or perhaps in-person banking. However, absolutely nothing regarding the historic list suggests depositors in 1984 and 2008 waited a few days and make withdrawals due to technical restrictions. Then they partners you to definitely looking on the danger posed in order to banking companies one to hold vast amounts out of uninsured places – sums surpassing the newest government deposit insurance rates cap of 250,one hundred thousand for each and every depositor, for each and every financial. Then they run individuals conditions to see how some other categories of banking companies manage do.

Todd Boehly’s Eldridge Marketplace, private borrowing company Ares Management as well as the secretive members of the family behind Northern Carolina’s First Residents Bank, and therefore gotten Silicon Area Lender from insolvency. Tucker graduated out of Duke University within the 2019 which have a primary inside math and offered while the football publisher for the pupil newsprint, The fresh Chronicle. Realize him for more exposure of money professionals and you can Wall structure Street’s successful and losing steps, and you may send reports suggestions to

Connects financial institutions and you may fintechs in order to con protection systems away from 200 research supply one be sure consumers’ identities while in the onboarding, display screen transactions to help you banner doubtful hobby and then make borrowing from the bank and conformity conclusion. The 500-as well as users were Yards&T Lender, Hide and various regional banking companies and borrowing unions. You to definitely long time Fintech 50 options that is shedding out of this current year’s number is Carta.

Highest Business Depositors

- The fresh core state, as the Buffett notices they, is the fact that the personal doesn’t understand that its financial places try secure, even those that is actually uninsured.

- The change inside An excellent/R try portrayed to your income statement (CFS), in which the ending equilibrium on the accounts receivable roll-send schedule moves within the as the stop equilibrium to your harmony piece, at the time of the modern months.

- That have a ten,100 lowest put to open up, these types of Cds is actually geared toward significant savers.

- Jelena McWilliams (née Obrenić; born July 31, 1973)1 are an excellent Serbian-American organization administrator and an old president of your Government Deposit Insurance Business.

- Yes, there is a large number of possibilities whenever paying a large sum of cash, but it all the boils down to your financial and you will life needs.

What it is of receivership are to business the new possessions from a good unsuccessful establishment, liquidate him or her, and spread the fresh continues on the institution’s financial institutions. The new FDIC since the person succeeds on the rights, efforts, and you will privileges of your organization and its particular stockholders, officials, and you can directors. It might gather all the financial obligation and cash as a result of the organization, preserve or liquidate their possessions and you may possessions, and you may perform any reason for the college consistent with the conference.

Discover a financial otherwise credit connection that provides an aggressive produce

Cds automatically replace after they mature following a great ten date grace months. Productivity is actually aggressive for everybody Cds, but Vio’s large APYs are to possess Dvds which have regards to three-years otherwise shorter. Dvds are best for anyone looking for a guaranteed rates away from go back one to’s generally greater than a family savings. In exchange for a higher price, fund are tied to own a set time frame and you can early withdrawal punishment could possibly get use.

When the Apple’s show speed develops from the a material annual rate of growth from 9percent along the next 5 years, it will strike through the 5 trillion top. Some you’ll take a look at Google mother Alphabet while the a keen underdog on the race to 5 trillion. Antitrust authorities ‘re going following the organization for the industry prominence in the electronic advertising. It has been a keen AI pioneer for many years possesses a particularly large gains opportunity featuring its Waymo notice-driving car equipment. It wasn’t all of that long ago you to traders pondered and therefore inventory is the earliest to arrive an industry cover out of 1 trillion.

It’s very a contributing property for the Wall Street Historic Region, a national Sign in from Historic Urban centers area created in 2007. Criminal fairness, when it comes to the fresh Goldmans and Morgan Stanleys of your own globe, isn’t adversarial treat, which have police and you may criminals duking it out in the interrogation bedroom and you can courthouses. Rather, it’s a cocktail-party anywhere between members of the family and associates which away from day in order to week and year to year are constantly modifying corners and you can exchange hats. During the Hilton appointment, bodies and you may banker-solicitors applied elbows while in the some speeches and committee discussions, off the rabble. “They were chummier in this ecosystem,” states Aguirre, who plunked off dos,2 hundred to go to the brand new meeting.